Consumer Prices Decline in June

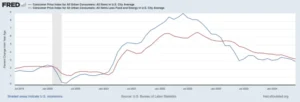

The Federal Reserve is trying to engineer a gradual disinflation. It is getting outright deflation. The Bureau of Labor Statistics reported that the Consumer Price Index (CPI) decreased 0.1 percent in June. Consumer prices have grown 3.0 percent over the last year, which is the lowest 12-month rate since March 2021.

Core CPI, which excludes volatile food and energy prices, increased 0.1 percent. Year-over-year core inflation was 3.3 percent, the lowest since April 2021.

Headline price decreases, driven by monetary tightening, are not necessary to get us back to the Fed’s target 2 percent growth path, but they do facilitate a quicker return. We may have reached a definitive point in policymakers’ (self-imposed) struggle against excessive dollar depreciation.

As with previous months, there are significant relative price dynamics underlying disinflation. The energy component of the CPI fell 2.0 percent in June. Gasoline in particular is down 3.8 percent. These changes more than outweighed continued growth in shelter prices. Outside of energy, the biggest movers were transportation services (-0.5 percent) and used cars and trucks (-1.5 percent). Most non-food and non-energy components increased slightly, which explains why core CPI inflation was still positive.

Let’s use the new inflation data to ascertain the stance of monetary policy. The current range for the Fed’s main policy interest rate is 5.25-5.50 percent. This is a nominal (current-dollar) rate. We need to adjust it for inflation. The CPI has grown at an annualized rate of 0.8 percent over the last three months. Hence the ex-post real policy interest rate was around 4.45-4.70 percent.

We need a benchmark for comparison to know whether money is loose or tight. Economists use the natural rate of interest: the hypothetical inflation-adjusted rate that balances supply and demand in short-term capital markets. Appropriate monetary policy ensures market rates track the natural rate. While the natural rate is unobservable, we can estimate it based on economic fundamentals. The New York Fed’s model put it somewhere between 0.70 and 1.18 percent in 2024:Q1.

This is remarkable. Market rates are not only above natural-rate estimates. They are significantly above that estimate — the levels are roughly 3 to 7 times as large! Perhaps the estimates are wrong. But it’s unlikely that the New York Fed has underestimated the natural rate by 200 percent or more. In terms of interest rates, this is what tight money looks like.

Of course, we should also look at the money supply. These figures are not as stark. M2, the most commonly cited measure, is once again growing. It’s about 0.55 percent higher today than a year ago. Richer measures of the money supply, which weight components based on liquidity, are growing between 1.00 and 2.05 percent per year.

Neutral monetary policy would ensure the money supply grows as fast as money demand. But money demand is hard to measure. The sum of population growth and real GDP growth is a reasonable proxy. US population growth at the end of last year was about 0.50 percent and real GDP is growing at just shy of 3.0 percent. Hence money demand is growing approximately 3.50 percent per year. None of the money supply figures are increasing this quickly, which suggests monetary policy is tight.

To sum up, interest rates tell us monetary policy is very tight. The money supply tells us monetary policy is somewhat tight. Will the Fed interpret recent data as a signal it’s time to pivot? The Federal Open Market Committee, which makes monetary policy decisions, next meets July 30-31. Markets don’t currently expect a rate cut. FOMC members have signaled they want to see persistently moderated price pressures before they lower their interest rate target. My guess is they will not cut rates this month, but provided the next PCEPI release matches the CPI, the stage will be set for beginning the path back to neutral monetary policy in September.

Editor’s note: This piece originally was published by the American Institute for Economic Research.